Investing 101: What Affects Precious Metal Prices?

There’s been a significant uptick in precious metal prices recently, as cryptocurrency and stocks have followed a steady decline. The latter two, of course, seem to constantly shift. Precious metals, though, have a tendency to only climb in value over time.

How do people start investing in precious metals, though? Well, it depends on what objective each investor has. Some might want to trade for short-term profits, while others look at gold and silver as long-term savings.

Some even consider precious metals a better alternative to storing funds in a bank account. For a better idea as to why, you might want to consider the different variables that affect the price of precious metals.

Investing in Precious Metals

Precious metal prices, in general, are affected by a few common factors. These factors are quite similar to those you’d find in almost any market, and with many other commodities. The first is demand; the more people want something, the higher its value will climb. And the opposite is true, as when there’s less availability the price usually climbs.

When you narrow down the selection, of course, different variables can come into play. Analyzing each of these is essential when looking at the various ways to invest in precious metals.

Determining Gold Price

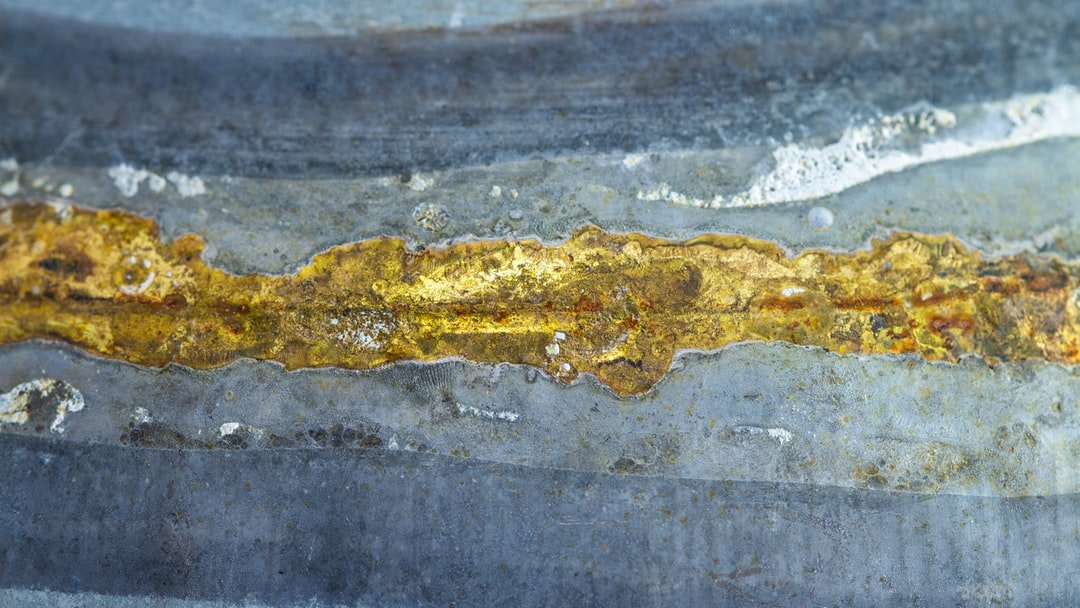

While many believe that the cost of gold is due to its long history of appearing as a symbol of luxury and wealth, the true is quite the contrary in today’s world. The gold price you’ll find nowadays has more to do with two primary factors. The first is the role it plays as a safe haven asset. The second has to do with its utility.

Gold has an inverse relationship with the US Dollar, as its seen as a substitute in terms of value. But, it’s a precious metal that’s present in a wide variety of important industries, including the following:

- Electronics

- Medicine

- Dentistry

- Aerospace

Looking at Silver Price

Silver is seen less as a safe haven asset but is still seen as better than a paper currency. This is primarily due to the fact that there’s a larger supply than gold. You’ll see silver vary in value based on inflation, economic trends, and demand in the technology industry. Interestingly enough, the silver price you find today is also impacted by gold prices!

The future of silver looks bright. If the solar power industry continues to climb in popularity, the demand for silver, as well as its value, will rise with it accordingly.

Gauging Precious Metal Prices

Precious metal prices, in general, are determined by similar factors to those found in almost any industry. When you start looking into the details surrounding particular metals, though, you’ll find that there are unique variables that set them apart. Gold and silver are both used in a plethora of industries, but the former also has a direct relationship with fiat currencies.

Hopefully, this article provided some useful information on the different variables that affect the price of precious metals. If it did, make sure to look at some of the other helpful posts on the site!